Papa John’s CEO John Schnatter has sold another big chunk of stock, according to a regulatory filing this afternoon, bringing to 411,050 shares the total he’s sold since announcing a special trading plan in early September under which he could sell up to 480,000 total.

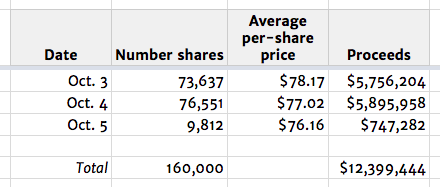

Combined proceeds so far from all the sales, according to Securities and Exchange Commission filings: $32.2 million. (Table shows all the trades.)

Today’s SEC filing says Schnatter, who founded the company in 1984, sold 86,314 shares yesterday and Wednesday for prices averaging from $80.07 to $81.02 a share. The proceeds were $6.9 million, most of it from a single sale of 63,318 on Wednesday — the largest such block since Boulevard began tracking a wave of sales he started under the trading plan.

Papa John’s stock closed at $80.45 this afternoon, up 47 cents.

Company executives often adopt “10b5-1” trading plans, named for the SEC rule that governs insider trading. They are often approved by a company’s board of directors, and require an executive to sell a certain number of shares at fixed intervals to avoid any appearance they’re trading on inside information.

BROWN-FORMAN has opened the second of three elaborate pop-up Jack Daniel’s-themed “general stores”as part of the company’s ongoing 150th anniversary promotions of the brand. The latest is in Chicago six days ending Oct.22 following a stop in New York City. Next up: Miami. The installation includes local barbers; a virtual reality tour of the distillery in Lynchburg, Tenn., daytime concerts, plus Southern cooking (

BROWN-FORMAN has opened the second of three elaborate pop-up Jack Daniel’s-themed “general stores”as part of the company’s ongoing 150th anniversary promotions of the brand. The latest is in Chicago six days ending Oct.22 following a stop in New York City. Next up: Miami. The installation includes local barbers; a virtual reality tour of the distillery in Lynchburg, Tenn., daytime concerts, plus Southern cooking (

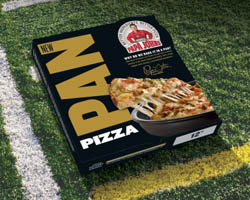

Papa John’s is promoting the new menu item with a specially designed black box, and a new advertising campaign featuring retired Denver Broncos quarterback Peyton Manning, NFL Defensive Player of the Year J.J. Watt, and CEO John Schnatter. (See, above.)

Papa John’s is promoting the new menu item with a specially designed black box, and a new advertising campaign featuring retired Denver Broncos quarterback Peyton Manning, NFL Defensive Player of the Year J.J. Watt, and CEO John Schnatter. (See, above.)